Struggling with mortgage payments? Stretching the term can help — but it will cost you. Here are the numbers

/in Blog /by Create WealthHOW SMALL BUSINESSES CAN STAY FINANCIALLY RESILIENT BY WORKING WITH A FINANCIAL PLANNER

/in Blog, Financial Planning, Insurance /by Create WealthWhy Young People Trust TikTok for Financial Advice

/in Blog, Business Owners, Financial Planning, Insurance, Investment, Savings, Starting your career /by Createwealth Planning2022 Financial Calendar

/in 2022, Blog, Financial Planning /by Createwealth Planning2022 Financial Calendar

Welcome to our 2022 financial calendar! This “at a glance” document lists important dates, including when government benefits are distributed and tax filing deadlines.

Be sure to bookmark this or add the dates listed to your personal calendar so you’re always in the loop!

Use our calendar to make sure you keep on track with your financial goals and avoid missing any critical tax or investment deadlines.

If you’re looking for help with your taxes, tax packages will be available in February 2022, so reach out to your accountant or us to book an appointment and get started on your taxes!

Important Dates

Dates to know:

-

January 1 is when the contribution room for your TFSA opens again. The maximum contribution for 2022 is $6,000.

-

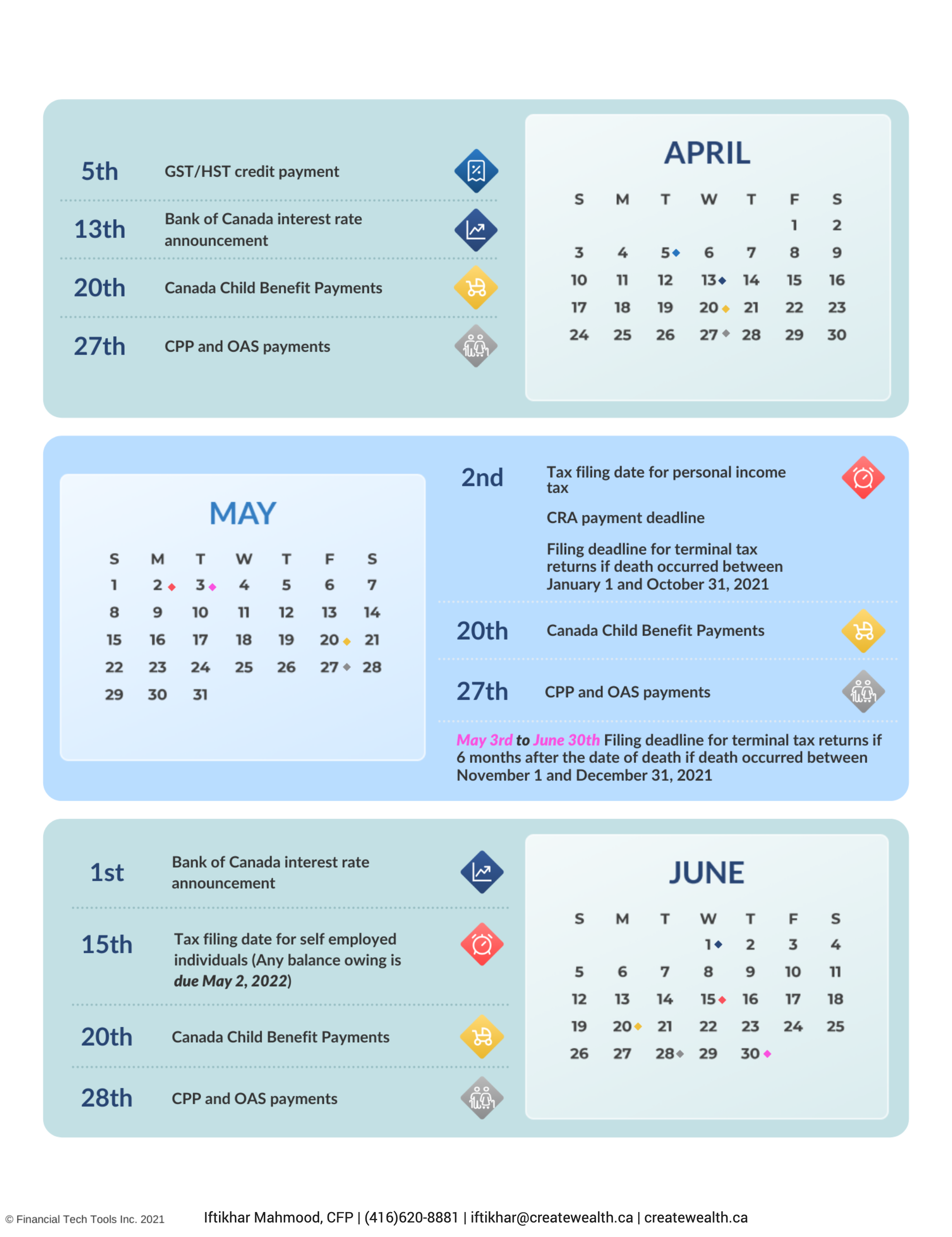

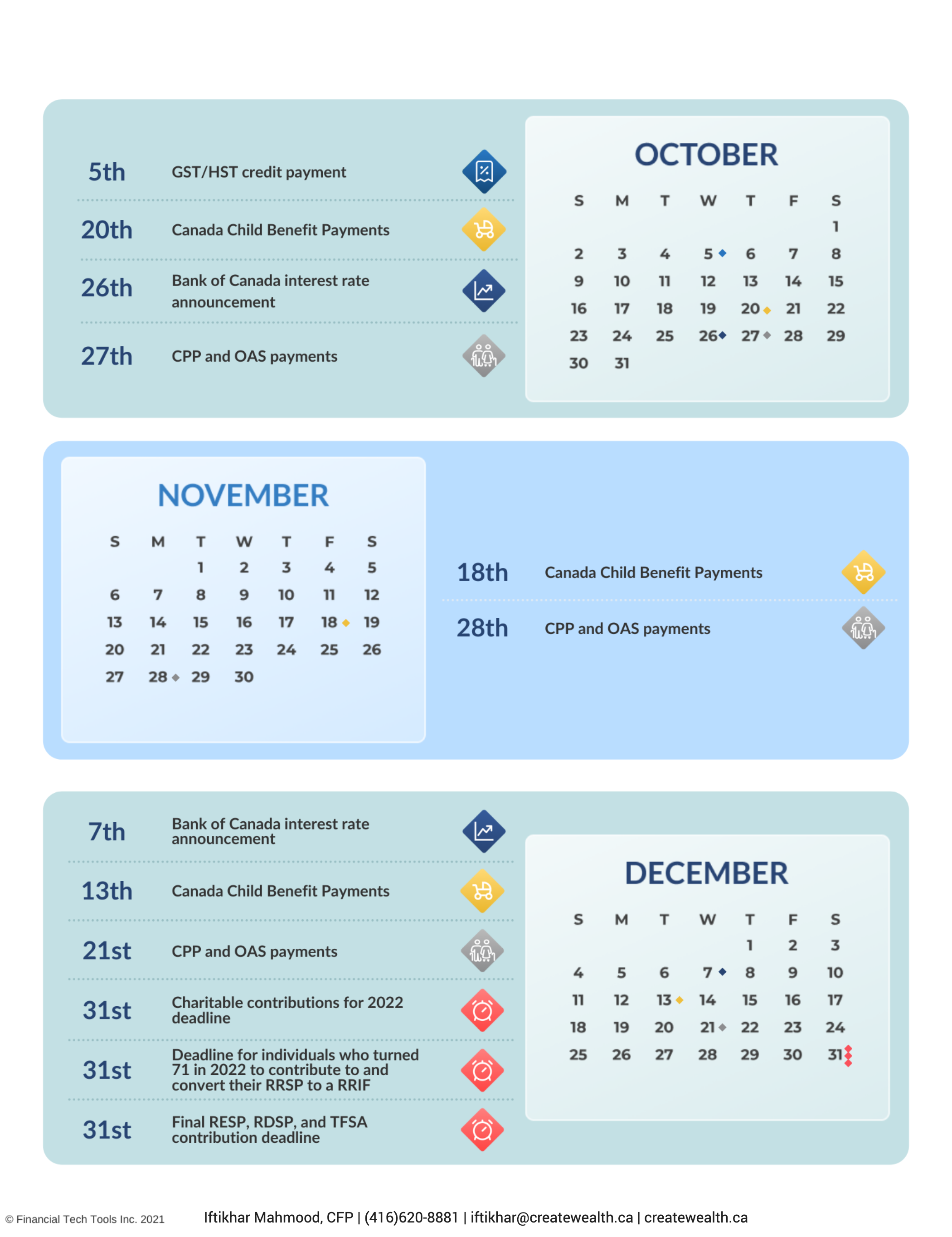

The government will issue GST/HST credit payments on January 5, April 5, July 5, and October 5.

-

Canada Child Benefit payments (CCB) will be issued on the following dates: January 20, February 18, March 18, April 20, May 20, June 20, July 20, August 19, September 20, October 20, November 18, and December 13.

-

The government will issue CPP and OAS payments on the following dates: January 27, February 24, March 29, April 27, May 27, June 28, July 27, August 29, September 27, October 27, November 28, and December 21.

-

The final date for your RRSP contributions to be eligible for the 2021 tax year is March 1, 2022.

-

Bank of Canada’s interest rate announcements will be on January 26, March 2, April 13, June 1, July 13, September 7, October 26, and December 7.

-

May 2, 2022, is the last day to file personal income taxes, and tax payments are also due by this date. This is also the filing deadline for final returns if death occurred between January 1 and October 31, 2021.

-

May 3 to June 30 – The filing deadline for final tax returns if death occurred between November 1 and December 31. The due date for the final return is six months after the date of death.

-

The tax deadline for all self-employment returns is June 15, 2022. Any balance owing, however, is due May 2, 2022.

-

The deadline for final RESP, RDSP, and TFSA contributions is December 31.

-

December 31 is also the deadline for 2022 charitable contributions.

-

December 31 is also the deadline for individuals who turned 71 in 2022 to finish contributing to their RRSPs and convert them into RRIFs.

Extended COVID-19 Federal Emergency Benefits

/in Blog, Coronavirus, Coronavirus - Associates, Coronavirus - Practice Owners, Coronavirus - Retiring /by Createwealth PlanningOn Friday, February 19, 2021, Prime Minister Justin Trudeau announced an extension to several of the COVD-19 federal emergency benefits. The goal of this extension is to support Canadians who are still being financially impacted by the COVID-19 pandemic.

The following benefits are impacted:

-

Canada Recovery Benefit

-

Canada Recovery Caregiving Benefit

-

Canada Recovery Sickness Benefit

-

Employment Insurance

Canada Recovery Benefit

The Canada Recovery Benefit (CRB) provides income support to anyone who is:

-

Employed or self-employed, but not entitled to Employment Insurance (EI) benefits.

-

Has had their income reduced by at least 50 percent due to COVID-19.

You can receive up to $1,000 ($900 after taxes withheld) a week every two weeks for the CRB. The recent changes now allow you to apply for this benefit for a total of 38 weeks – previously the maximum was 26 weeks.

Canada Recovery Caregiving Benefit

The Canada Recovery Caregiving Benefit (CRCB) helps support people who cannot work because they must supervise a child under 12 or other family members due to COVID-19. For example, a school is closed due to COVID-19 or your child must self-isolate because they have COVID-19.

You can receive $500 ($450 after taxes withheld) for each 1-week period you claim the CRCB. The recent extension made now allows you to apply for this benefit for a total of 38 weeks instead of the previous 26 weeks.

Canada Recovery Sickness Benefit

The $500 a week ($450 after taxes) Canada Recovery Sickness Benefit (CRSB) is also getting a boost. If you cannot work because you are sick or need to self-isolate due to COVID-19, you can now apply for this benefit for a total of four weeks. Previously, this benefit would only cover up to two missed weeks of work.

Employment Insurance

Finally, the government will also be increasing the amount of time you can claim Employment Insurance (EI) benefits. You will now be able to claim EI for a maximum of 50 weeks – this is an increase of 24 weeks from the previous eligibility maximum.

For full details, go to https://www.canada.ca/en/revenue-agency/campaigns/covid-19-update/covid-19-benefits-credits-support-payments.html

Self-employed: Government of Canada addresses CERB repayments for some ineligible self-employed recipients

/in Blog, Coronavirus, Coronavirus - Associates, Coronavirus - Practice Owners /by Createwealth PlanningGreat news for some ineligible self-employed Canadians who received the Canada Emergency Response Benefit (CERB). As per canada.ca:

“Today, the Government of Canada announced that self-employed individuals who applied for the Canada Emergency Response Benefit (CERB) and would have qualified based on their gross income will not be required to repay the benefit, provided they also met all other eligibility requirements. The same approach will apply whether the individual applied through the Canada Revenue Agency or Service Canada.

This means that, self-employed individuals whose net self-employment income was less than $5,000 and who applied for the CERB will not be required to repay the CERB, as long as their gross self-employment income was at least $5,000 and they met all other eligibility criteria.

Some self-employed individuals whose net self-employment income was less than $5,000 may have already voluntarily repaid the CERB. The CRA and Service Canada will return any repaid amounts to these individuals. Additional details will be available in the coming weeks.”

For full details, see full news release at https://www.canada.ca/en/revenue-agency/news/2021/02/government-of-canada-announces-targeted-interest-relief-on-2020-income-tax-debt-for-low–and-middle-income-canadians.html

CreateWealth Planning

Iftikhar Mahmood, CFP®

CERTIFIED FINANCIAL PLANNER®

Serving the Greater Toronto Area.

About CreateWealth

Helping business owners and professionals design and achieve their lifelong goals.

Comprehensive Financial Planning isn’t just a notion but a truly comprehensive way of helping our clients throughout their lives. It's about understanding more about you, your motivations, aspirations, hopes and dreams for life. Ultimately it stems from the belief that your money is there to help you live the life that you want.

This individual is registered as an Exempt Market Dealer dealing representative sponsored by Rethink and Diversify Securities Inc. in the province of Ontario.